Several strategies have been implemented by banks in order to promote their products and services and bank brands as well. It is my pleasure to be here today at this conference organised by ASLI to speak on the current issues and developments in Islamic banking and finance.

Pdf Market Risk And Efficiencies Of The Malaysian Banking Industry The Post Merger And Acquisition Examination

This situation is made worse by the fact that due to shortage of cyber-security professionals in Malaysia banks may soon find that it will become increasingly.

. Came across Asia financial crisis in 1997 and global financial crisis in 2007 Malaysian banks have learned valuable and memorable lesson resulting. Consumer expectations These days its all about. There are number of challenges need to be faced by Malaysian banks however the opportunity in this industry is high due to the current trend especially application and development of ICT.

After the Asian financial crisis of 1997-1998 Malaysias economy has. The Malaysian banking sector has played a leading role in indirect financing while experiencing problems similar to those of other Asian countries suffering from the financial crisis. Theyll need to provide tailored guidancewith respect to current challenges and actionable advice for the long-term.

Hence Movement Control Order MCO has been implemented to curb the outbreak. The covid-19 crisis will come on top of the pre-crisis challenges of the traditional banking business model. Banking analysts are mixed about the performance of the local banking sector this year owing to uncertainties on the post-loan moratorium and Covid-19 related challenges.

With a series of high-profile breaches over the past few years security is one of the leading banking industry challenges as well as a major concern for bank and credit union customers. The longer banks wait the more they risk being left behind Stephens told the recent Asian Banking Summit in Kuala Lumpur. A flexible exchange rate will increase the countrys.

Our survey with consumers in November 2019 revealed that 45 of Malaysians are looking for virtual banking service providers to offer a better mobile and digital experience. The Islamic financial system in Malaysia has evolved as a viable and competitive component of the overall financial system complementing the conventional financial system as a driver of economic. The other factors are saving account current account transaction summary report e-payments fund transfer credit card services cheque services and.

Financial viability this includes maintaining an asset threshold of no more than RM2b in the. This has lead some expats to ask us whether this is a bump in the road or a more serious problem. Openness to trade and investment has been instrumental in employment creation and income growth with about 40 of jobs in Malaysia linked to export activities.

Security is one of the most significant challenges for online banking marketers because of the inherent concerns that are traditionally associated with banking online. Conventional banking has seen its day Accenture said. Posted on July 28 2015.

Capital strength to safeguard the integrity and stability of Malaysias financial system in a time of economic challenges amid COVID-19 applicants will need capital funds of minimum RM100m in the foundational phase and RM300m thereafter. A recent study by Frost Sullivan indicated that the potential economic loss in Malaysia due to cyber-security incidents can reach up to 4 of Malaysias Gross Domestic Product GDP. During the MCO there are some problems have been faced by bank marketing and these problems have created great impacts for banks.

NPL problems faced by the banking system. Malaysia is currently facing some real challenges over and above lower oil prices the falling value of the ringgit and a slowdown in the rate of economic growth. For the next several years Malaysia will face challenges and fiscal belt -tightening.

The year obviously kicked off on a high note with Bank Negara Malaysias BNM growth target set at 6-75 per cent but it was later revised down to 3-4 per cent amid the re-imposition of COVID. Bank Negara Malaysia BNM has provided automatic payment moratorium for. The top 4 challenges facing the banking industry and financial institutions.

Revenue pressure and low profitability low levels of interest rates and higher levels of capital tighter regulation after previous financial crisis and increasing competition from shadow banks and new digital entrants. Banks in Malaysia face a series of challenges. The answer depends on who you talk to.

Theyre still on the mend following the 1997 economic crisis and the fintech -- financial technology -- revolution together with the growing digital banking trend is rewriting how business gets done. Heres our take on the issues and options facing banks today and some suggested ways to replot the post-COVID-19 strategy. The Islamic finance industry in Malaysia is characterised by having comprehensive market components ranging from Islamic banking takaful Islamic money market and Islamic capital market.

The Malaysian banking system is at its strongest thanks to lessons learnt and foundations put in place after previous crises but is it enough to overcome an unprecedented calamity that has upended economies the world overBank Negara Malaysia deputy governor Jessica Chew does not discount that the risks are great and recognises that the challenges. Downtime will damage the customer experience and erode efforts made to build trust with them given that digital banking service providers are new to consumers in Malaysia. Bank Negara the countrys central banks primary economy support is prudent financial market measures and policies.

Not making enough money Despite all of the headlines about banking profitability banks and financial institutions still are not making enough return on investment or the return on equity that shareholders require. According to RAM Ratings Malaysia was the top sukuk issuer with US139 bil ringgit equivalent or 351 of the US395 bil ringgit equivalent sukuk issued. Consequently public sector expenditure is forecast to drop 18 percent in 2019.

Roles and challenges of banks during the pandemic. The Malaysian government implemented Movement Control Order MCO on 18 March 2020 as a preventive measure against the COVID-19 pandemic. The direct reasons for the prob-.

Although banking systems are designed to be virtually impenetrable cyberattacks and fraudulent activity are still a reality. By Dr Yii Kwang Jing. Whats more Malaysian banks are struggling to connect with an emerging millennial population.

Banks in Malaysia need to make structural changes not just incremental ones and understand that time is of the essence in this current climate. Malaysian banks have fared well in 2019 amid financial technology fintech disruption that is reshaping the industry and external headwinds and uncertainties brought by among others Brexit and the trade spat between the United States and China. The lockdown also induced the closure of all industries except for infrastructure services supermarkets wet markets and multi.

Malaysia is one of the most open economies in the world with a trade to GDP ratio averaging over 130 since 2010.

Digital Banking How Does It Impact The Malaysian Economy

The Malaysian Financial System Download Table

Malaysian Households During Covid 19 Fading Resilience Rising Vulnerability

Pdf Competition In The Malaysia S Banking Industry Quo Vadis 18 Ijem S3 2017 R2 Competition In The Malaysia Banking Industry

Accelerating Esg Integration In Malaysian Banks

Impacts Of Covid 19 On Firms In Malaysia Results From The 3rd Round Of Covid 19 Business Pulse Survey

Factors Influence Development Of E Banking In Malaysia Open Access Journals

Genting Hong Kong S Demise Leaves Malaysian Banks And Its Government Facing Us 600 Million Question South China Morning Post

Malaysian Banks To Face Tightening In Funding Conditions In 2022 The Star

Malaysians Say Country S Financial Sector Has A Good Reputation Bebasnews

Factors Influence Development Of E Banking In Malaysia Open Access Journals

The Malaysian Financial System Download Table

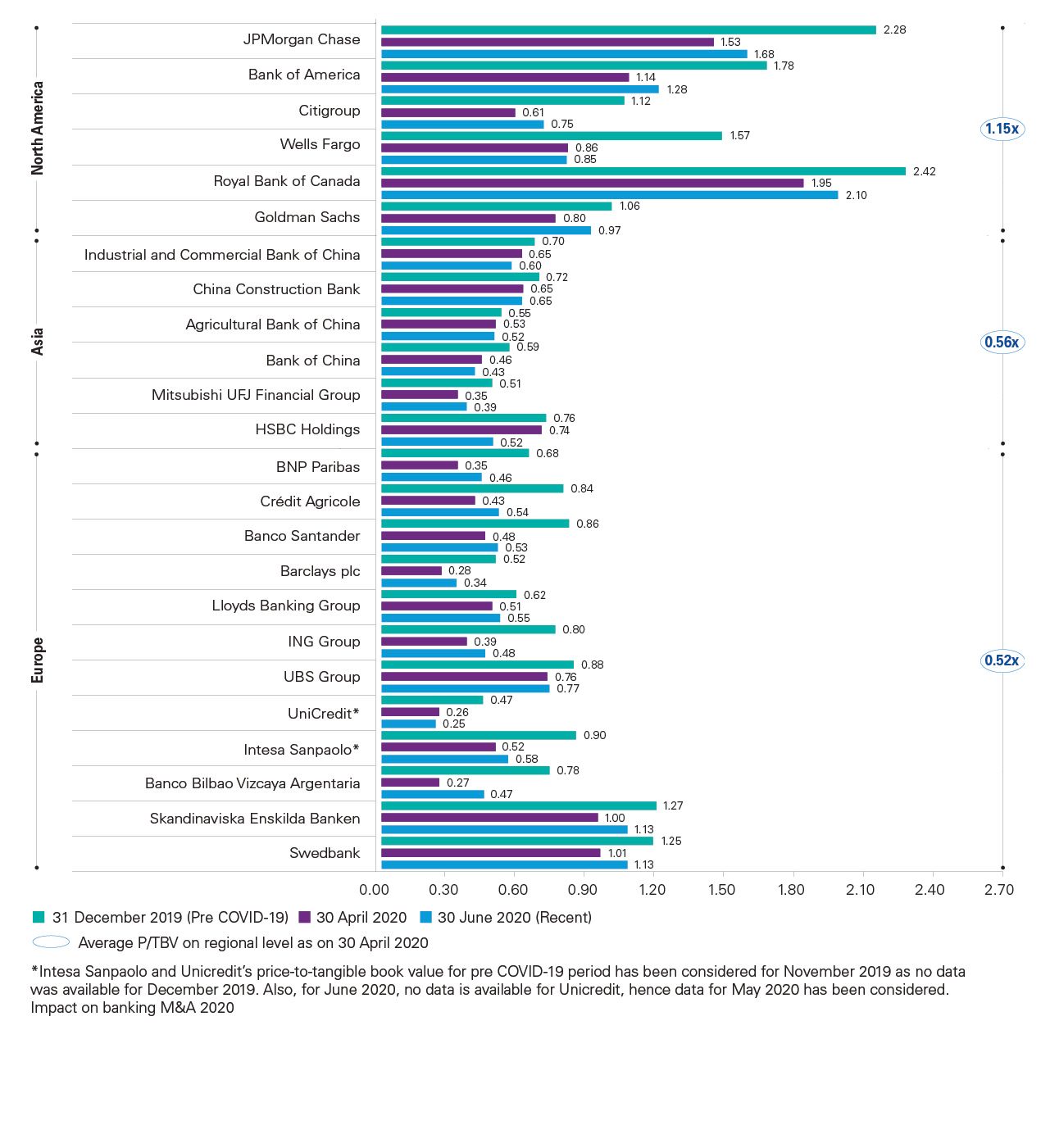

Covid 19 Impact On The Banking Sector Kpmg Global

Consumer Lending In Malaysia To Slow Down Due To Covid 19 Pandemic Says Globaldata Globaldata